Architecture

DID YOU KNOW?

- Many design activities performed by architecture firms, especially those during the Schematic Design, Design Development, and Construction Documentation phases may qualify for sizable federal and state R&D tax credits.

- While contractual language is a relevant factor, qualifying activities under contracts with clients can also qualify in many cases.

- Expertise includes industry standard tracking and job costing software, which provides for efficient cost analysis and excellent substantiation.

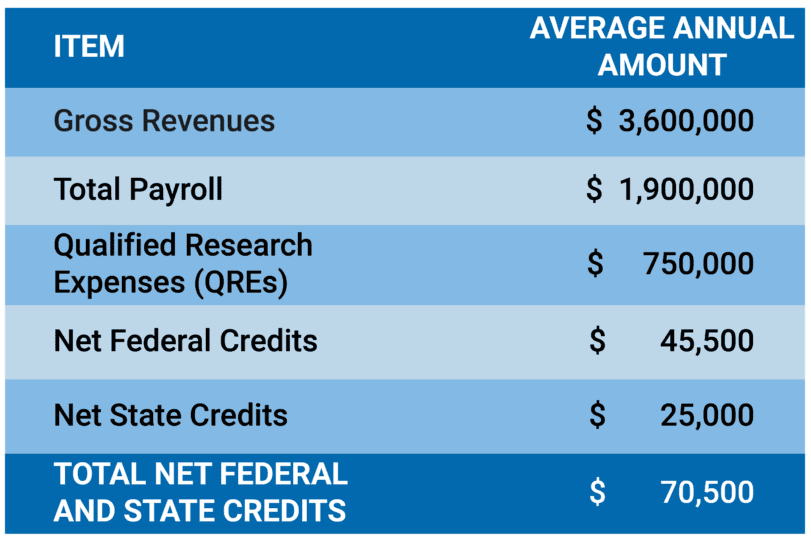

- The R&D tax credit is based on “qualified research expenses” (QREs) – for every dollar spent on QREs, you can earn up to 8.0% in federal tax credits! Additionally, over 40 states offer similar R&D tax incentives that can double benefits in some cases.

ARCHITECTURE CASE STUDY

QUALIFYING ACTIVITIES

Design & Analysis

Feasibility Studies

SD, DD, & CD Development

CAD & BIM Modeling

Technical Studies

Architecture & Engineering Services

Building & Landscape Architecture

Structural Engineering

Mechanical, Electrical, and Plumbing Engineering

Civil & Environmental Engineering

Other Specialty Engineering