Homebuilders & Developers

DID YOU KNOW?

- Homebuilders & Residential Developers of single-family and multi-family homes/structures (3 stories or less) can qualify for $2000/home or unit with the 45L Energy Efficient Residential Tax Credit if they meet certain energy efficiency criteria.

- Manufactured Homes Producers can qualify for $2000/home or $1000/home depending on the energy efficiency criteria met with the 45L Tax Credit.

- Homebuilders & Developers (maintaining ownership) of multi-family or mixed-use structures over 3 stories can qualify for the 179D Energy Efficient Commercial Building Tax Incentive, and/or Cost Segregation.

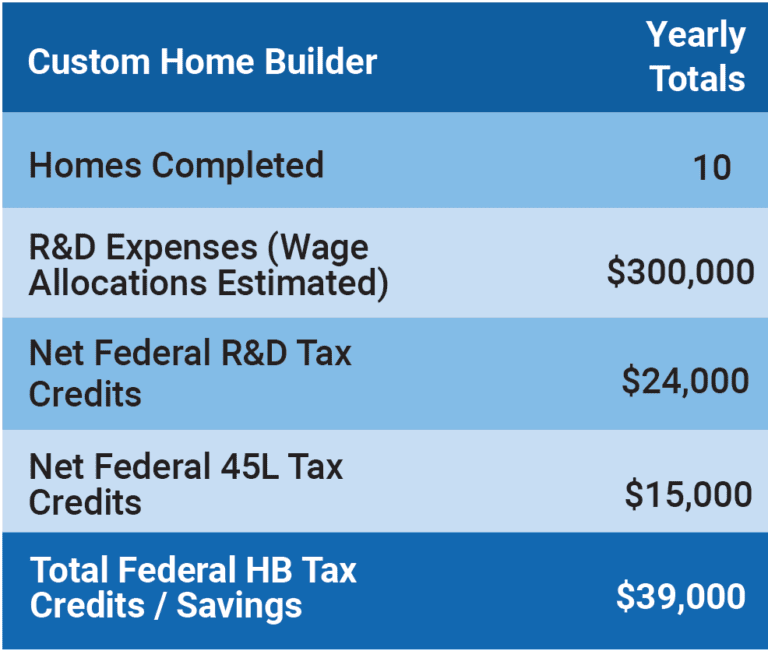

- Homebuilders & Developers with in-house design staff may also qualify for R&D tax credits.

CUSTOM HOMEBUILDER CASE STUDY

QUALIFYING BUILDER RELATED R&D ACTIVITIES

Engineering of foundational, structural, mechanical, and electrical sub-systems

Development of construction techniques for improved construction efficiency and implementation performance

Value engineering assessments to reduce cost while achieving constructible building and infrastructure designs

Building sub-system design, coordination, and clash detection using BIM or CAD modeling to ensure a reliable and efficient construction process