Biotechnology

DID YOU KNOW?

- Biotechnology, pharmaceutical, and medical device companies are prime candidates for valuable federal and state R&D tax credits.

- Many of the drug & product development and process improvement activities performed by biotechnology companies may qualify for sizable federal and state R&D tax credits.

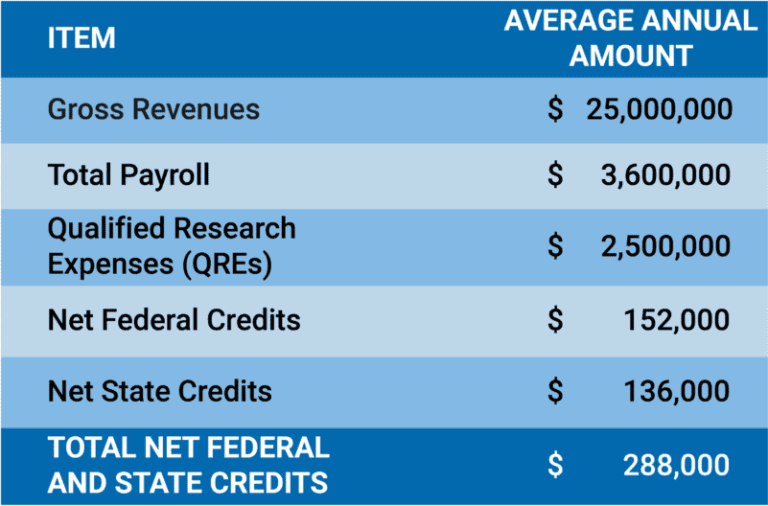

- The R&D tax credit is based on “qualified research expenses” (QREs) – for every dollar spent on QREs, you can earn up to 8.0% in federal tax credits! Additionally, over 40 states offer similar R&D tax incentives that can double benefits in some cases.

BIOTECHNOLOGY MANUFACTURING CASE STUDY

BIOTECHNOLOGY MANUFACTURING QUALIFYING ACTIVITIES

Product Design & Testing

First-Article Runs

Clinical Trials

CNC Programming

Tooling Development

Equipment Development

Process Design & Development

Quality Assurance

DRUG DEVELOPMENT QUALIFYING ACTIVITIES

Identification of Receptor Targets

Computer Modeling

Assay Development

Pharmacology

Clinical Testing

Process Design & Validation

Equipment Selection