Energy

DID YOU KNOW?

- Many of the tooling design, extraction technique, and refinery process development projects performed by oil and gas companies may qualify for sizable federal and state R&D tax credits.

- The R&D tax credit is based on “qualified research expenses” (QREs) – for every dollar spent on QREs, you can earn up to 8.0% in federal tax credits! Additionally, over 40 states offer similar R&D tax incentives that can double benefits in some cases.

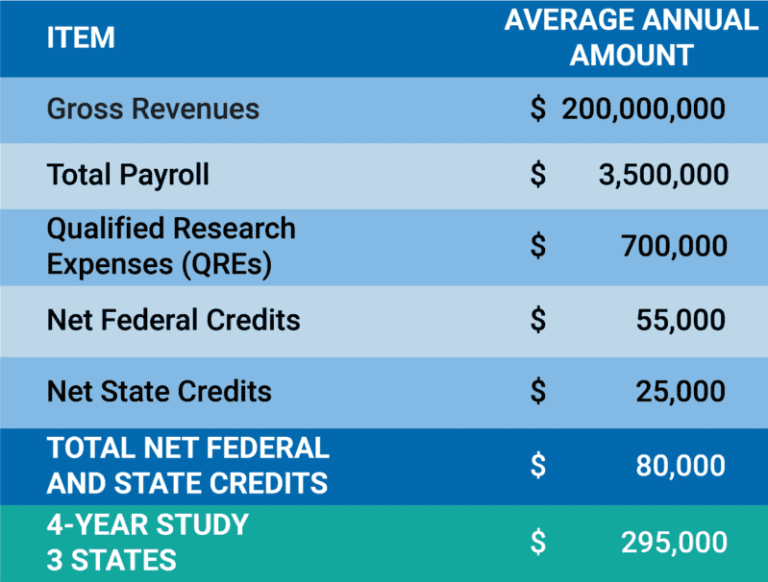

PETROLEUM PUMP MANUFACTURING CASE STUDY

QUALIFYING ACTIVITIES

Designing New or Improved Refinery Plants & Processes

Developing New or Improved Extraction Processes & Techniques

Designing and Testing on Offshore Rigs and Structures

Developing New or Improved Drilling Mud Formulations

Improving Refinery Yield and Minimizing Scrap & Waste

Designing and Manufacturing First Article Drill Bits, Pumps, and Other Equipment