Transportation

DID YOU KNOW?

- The federal government and most states have enacted fuel tax breaks for transportation and other fuel consuming companies for various uses of gasoline, diesel, and other common fuels.

- For federal purposes, taxpayers may be eligible for refunds of tax paid on gallons of certain fuels used in vehicles and equipment off-road, such as in farm equipment, compressors, generators, and bulldozers.

- Many states offer a wider range of refund opportunities than the federal government, extending exemptions to vehicles licensed for on-road use, such as cement mixers and garbage trucks.

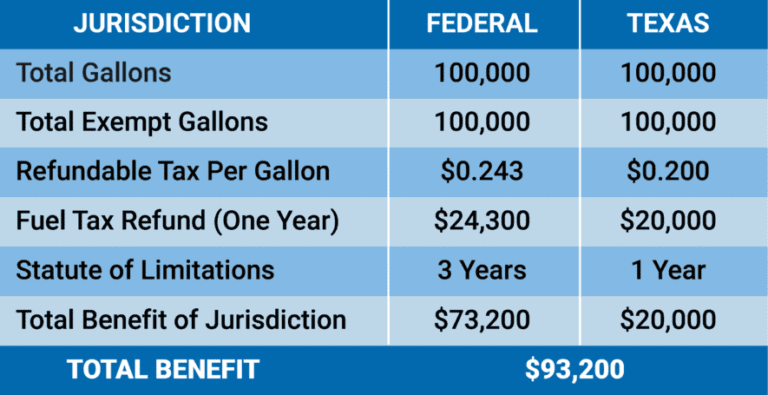

TRANSPORTATION CASE STUDY

QUALIFYING VEHICLES & EQUIPMENT

On-Road Vehicles w/PTO Equipment

Cement Mixers

Trash Compactors

Dump Trucks

Bucket Trucks

Solid & Liquid Cargo Pumps

Carpet Cleaning Vehicles

Refrigerated Truck/Trailer

Auxilary Power Units (APUs)

Mass Transit

School & Local Buses

Van Services

Off-Road Vehicles & Equipment

Construction Equipment (generators, dozers, etc.)

Oilfield Service Equipment

Lawn Maintenance Equipment

Farming Equipment

Marine Vessels

Forklifts

Other Opportunities

Taxicabs

Government Owned Vehicles

Diesel-powered Trains

WHO CAN BENEFIT?

Common/Private Carriers

Waste/Sanitation

Construction

Oil & Gas & Oilfield Service

Farming/Agriculture

Chemical

Food Service

Manufacturing

Passenger Transit

Mining/Industrial