Construction

DID YOU KNOW?

- Certain design, preconstruction, estimating, and upfront planning activities for construction projects may qualify for sizable federal and state R&D tax credits.

- While contractual language is a relevant factor, qualifying activities under contracts with clients can also qualify in many cases.

- Expertise includes industry standard tracking and job costing software, which provides for efficient cost analysis and excellent substantiation.

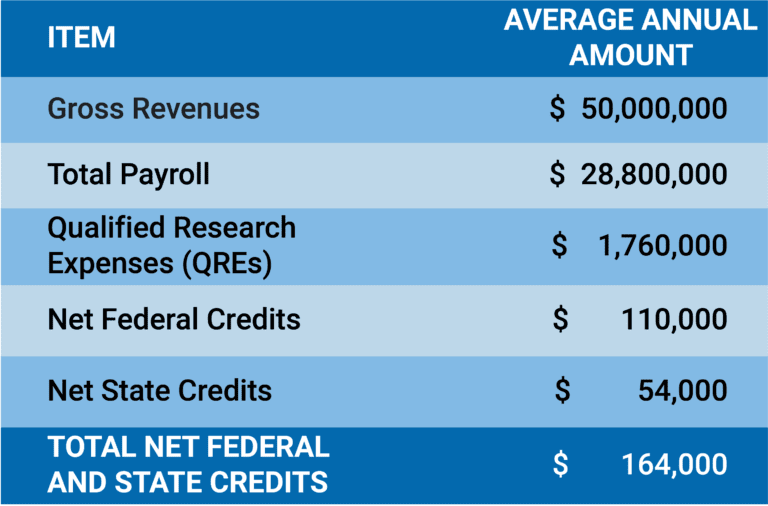

- The R&D tax credit is based on “qualified research expenses” (QREs) – for every dollar spent on QREs, you can earn up to 8.0% in federal tax credits! Additionally, over 40 states offer similar R&D tax incentives that can double benefits in some cases.

MECHANICAL CONTRACTOR CASE STUDY

QUALIFYING ACTIVITIES

Engineering of foundational, structural, mechanical, and electrical building sub-systems

Development of construction techniques for improved construction efficiency and implementation performance

Value engineering assessments to reduce cost while achieving constructible building and infrastructure designs

Constructability reviews of the design work of architects and engineers

Building sub-system design, coordination, and clash detection using BIM or CAD modeling to ensure a reliable and efficient construction process