FOOD & BEVERAGE

DID YOU KNOW?

- Due to the dynamic nature of the food and beverage industry, many companies are prime candidates for tax breaks.

- Companies developing new or improved food or beverage products, manufacturing processes, and packaging can qualify for sizable federal and state R&D tax credits.

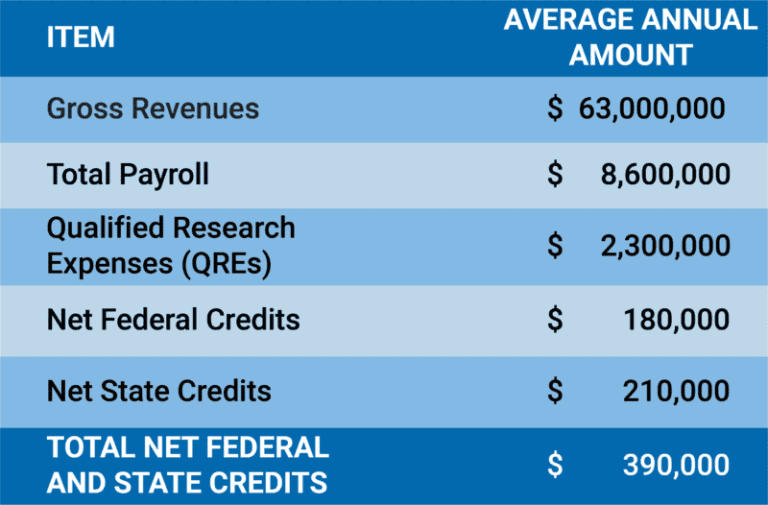

- The R&D tax credit is based on “qualified research expenses” (QREs) – for every dollar spent on QREs, you can earn up to 8.0% in federal tax credits! Additionally, over 40 states offer similar R&D tax incentives that can double benefits in some cases.

FOOD MANUFACTURER CASE STUDY

QUALIFYING ACTIVITIES

Developing new or improved product formulations to enhance flavor or increase nutritional content

Creating new or improved food manufacturing processes to meet federal, state, and local health guidelines

Producing pilot batches of foods or beverages for shelf life and stability analysis

Integrating new or different ingredients for improved taste, smell, or texture

Designing new packaging for improved temperature regulation or durability

Modifying formulations to include more sustainable ingredients