Real Estate

DID YOU KNOW?

- Many components of buildings can be reclassified as 5, 7, or 15-year assets from their original 27.5 pr 39 year lives.

- This provides the benefit of accelerated depreciation, which reduces taxes and increases cash flow.

- Building owners can take advantage of the ability to look back and “catch-up” lost depreciation deductions.

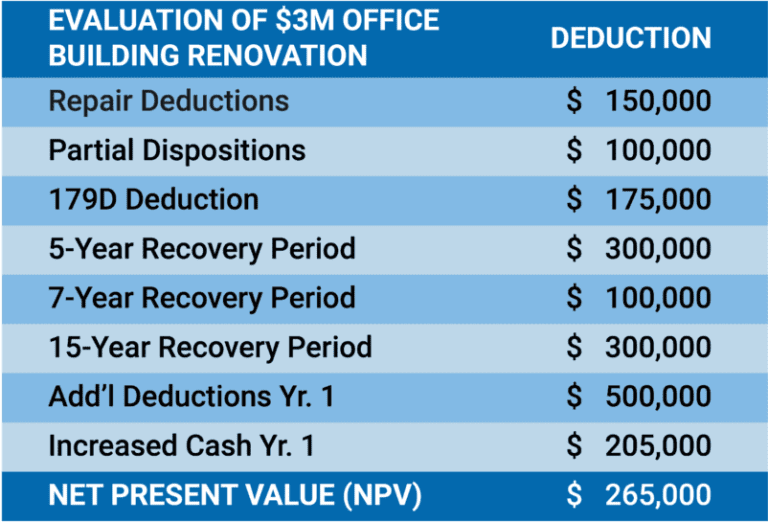

COST SEGREGATION FOR REAL ESTATE CASE STUDY

ELIGIBLE COST SEGREGATION PROJECTS

Commercial & Residential Building Owners, Developers, REITs, etc.

New Construction

Repairs and/or Improvements

Acquisitions